Board Meeting Minutes: A Complete Guide and a Free Template

Posted: 07.22.2020

Board meeting minutes are certainly tedious, and at times, the board secretary position seems like a thankless job. However, the task is incredibly important.

For one, board meeting minutes are critical for maintaining a historical log of decisions, and they’re also imperative for meeting legal requirements of your nonprofit organization. In fact, many organizations have learned that referring back to well-kept minutes has helped them deal with legal issues, saving both time and money for the organization.

With all that rides on the minutes, it’s not a task that should be taken lightly. Learning how to take effective minutes at a board meeting is worth the time and energy investment, and your fellow board members will appreciate the end results.

To ensure you’re taking the most effective board minutes possible, we’ve compiled a complete guide that covers the ins-and-outs of minute taking. Before jumping into the nitty-gritty details of effective nonprofit board meeting minutes, let’s take a moment to define what they are to make sure we’re all on the same page.

If you are tired of spending hours of time and reams of paper producing a cumbersome board book for every board meeting, we’ve got help.

Maybe it’s time to consider blowing up the board book. Download our free ebook to learn how to do exactly that! You can shave your meeting prep time from hours or day to just minutes. What’s more, your board members will be able to prepare for meetings from anywhere–digitally!

What Are Board Meeting Minutes?

Board meeting minutes record the board of director’s actions and decisions. They serve as an official and legal record of nonprofit board meetings, which means they should include more than a simple overview of discussions. The core purpose of board meeting minutes is to show that the board members did the following:

- Followed relevant procedures.

- Complied with the state laws pertaining to tax-exempt nonprofits.

- Obeyed the organization’s own bylaws and aligned decisions with its mission.

Now that we’ve reviewed the basics of what board meeting minutes are, we can take a deep dive into all they entail, so you can start creating effective board meeting minutes in no time. Here’s what we’ll cover:

1. What Are the Benefits of Board Meeting Minutes?

2. How to Take Minutes at a Board Meeting

3. What Not to Include in Board Meeting Minutes

4. Board Meeting Minutes Template

5. How Board Minutes Tools Can Help

Feel free to use the jump links above to navigate to the section most pertinent or intriguing to you. Otherwise, let’s start from the top with the benefits of effective board minutes so you can start running more productive meetings!

1. What Are the Benefits of Board Meeting Minutes?

Beyond documenting that a meeting did in fact occur, nonprofit board meeting minutes are helpful for a number of reasons. Before taking minutes yourself, it’s important to understand these reasons to ensure you’re documenting all relevant actions.

To get a firm grasp on the purpose behind taking minutes, let’s explore the top three benefits of recording effective notes:

- Once approved, board minutes become a legal record of what actually occurred in the meeting. In the event of a lawsuit, minutes can be subpoenaed, and in turn, board members could potentially be held liable. If important details are missing or if votes are recorded incorrectly, this could be disastrous for the nonprofit and its board members.

- Effective board meeting minutes serve as a valid reference point for future decision-making. They act as a reminder of what was addressed in the meeting, who said what, what the designated next steps were, and who is taking responsibility for what upcoming projects.

- Prospective sponsors looking to expand their philanthropic efforts or other funding sources can access board meeting minutes. Funders can use minutes to determine how effective the board is in leading the organization toward its goals. In other words, this could be the determining factor in whether someone chooses to financially support your cause.

As you can see, nonprofit board meeting minutes are an important resource, not just for future reference by the board itself but also for legal purposes. Now, let’s dive into best practices for creating coherent, well-organized board minutes.

2. How to Take Minutes at a Board Meeting

Creating complete nonprofit board meeting minutes that meet the needs of those who use them is crucial for effective decision-making and record-keeping at your organization. So that you can create the most efficient minutes possible, let’s explore best practices for documenting a clear and accurate account of your board’s actions.

1. Use Your Agenda as a board meeting minutes template.

As with most meetings, planning ahead is critical to create a defined outline that will lead your board meeting in effective conversation. If board administration creates a board meeting minutes template that’s blended with the agenda, taking minutes becomes incredibly straightforward and much less prone to error.

Many board secretaries or administrative staff create a note-taking outline a few days before the meeting. Consider using the meeting agenda as a guideline, and outline important issues that will be covered. This outline gives you a predefined structure to follow, so you can spend more time listening and accurately capturing the conversation, rather than trying to start from scratch and record everything on the fly.

2. Assign a Minute-Taker in Advance.

Putting a board member on the spot could come as a very unpleasant surprise. In fact, this will certainly compromise the quality of that board member’s engagement and participation levels and could even go as far as to compromise the quality of the meeting minutes. Because of this, you’ll want to choose a minute-taker in advance.

Have the same person take minutes at every meeting and designate a backup person to take them for when that regular minute-taker is unable to attend. This allows these individuals to familiarize themselves with the process and will ultimately lead to stronger, clearer board minutes. Typically, the designated minute-taker is the board’s secretary.

After appointing the task to someone, you’ll want to make expectations crystal clear. This includes:

- What format should be used – Is there a particular format that your minute-taker should mimic? The exact format used varies by the organization, although best practices for governance indicate that all should include some basic information, such as essential details regarding motions and voting. Using past board minutes as a template can be an effective option, and a minutes maker tool will streamline this process further.

- Whether or not they should participate in the discussion – Is your minute-taker a board member? If not, they should NOT participate in any discussion unless expressly invited to do so. A case in which they’re invited to participate may be when the board wishes to hear a non-board member’s perspective on an issue.

- How they should take minutes – Technology can streamline the process of taking accurate minutes but only if the minute-taker knows how to operate the board minutes system. During the meeting is not the optimal time for learning how to use these tools, so be sure your minute-taker undergoes training to become familiar with them beforehand.

2. Write in an Objective Voice.

One of the most important aspects for your board secretary to remember is that board meeting minutes must be written objectively. When you encounter controversial issues or contentious votes, attempt to summarize the debates and arguments. Weed out all the emotion by following these suggestions:

-

Stick to the facts, including votes in favor of a motion, votes against a motion, abstentions, and pertinent details about discussions. Listen carefully to the main topics and simply document significant portions of the discussion.

-

Ask a third party — someone who is not on the board— to read the board minutes to give you an unbiased opinion. When doing so, make sure the third party is not privy to any confidential information.

-

Return to them the next day. Since the secretary is also a voting board member, recording information objectively can be challenging. If you’re unsure if your board minutes are objective, sleep on it and re-read them the next day with a fresh mind.

By following these tips to ensure objectivity, you’ll create unbiased notes that capture essential information for future reference.

3. Include Pertinent Details.

Board meeting minutes are a matter of law for nonprofits. They serve as the official record to show that the meeting was actually held and important matters were discussed, and as such, it’s always important to capture all necessary details.

While there are no legal rules for what information board meeting minutes must include, most boards base their outlines on Robert’s Rules of Order. Full use of these rules would be cumbersome for most nonprofits, but limited use can be helpful in maintaining order and quickly addressing agenda items. When following Robert’s Rules of Order, board minutes must include:

- The type of meeting.

- The date, time, and location of the meeting.

- A list of attendees, including nonvoting participants with their names, titles, and reasons for attending.

- When the meeting was called to order and when it was adjourned.

- A record of motions, seconds, and whether or not the motion passed.

Overall, aim to create board meeting minutes that are specific enough to capture the board’s focus and decisions, but not so sparse that you can’t decipher what actually occurred during the meeting a few months down the line. Plus, scant board minutes could open up the board up to liability issues, so you never want them to be so minimal that they raise suspicions.

Think of it this way: major decisions and discussion points should always be captured but in a “short and sweet” fashion.

4. Proofread and Share Minutes Securely.

When all is said and done, you’ll want to review your board meeting minutes before sharing them. Be sure they’re consistently formatted and presented. If there are side notes that need to be rewritten into the minutes, see to it promptly after the meeting.

From here, board minutes should be finalized and distributed to attendees as soon as possible while the meeting is still fresh in the board and minute taker’s memory. A secure platform will allow board members to readily open board meeting minutes, the agenda, and any other pertinent documents.

3. What Not to Include in Board Meeting Minutes

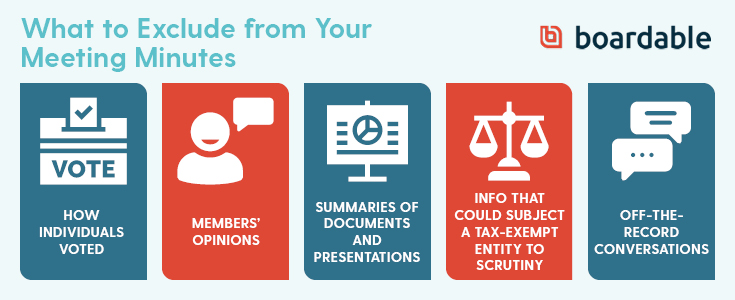

Knowing what to leave out of board meeting minutes is just as significant as knowing what to include. With this in mind, let’s explore five things nonprofit boards commonly record but shouldn’t.

1. Don’t Include How Individuals Voted.

In each of your board meetings, you’ll likely have a handful of items that need to be voted on. While you should name who made and seconded the motion, you shouldn’t include how individuals voted. Exclude their names and simply note the number of those in favor, those against, and those who abstained. As a general rule, keep the record impersonal.

However, there is an exception to this rule. If financial transactions involving board members come up or if the executive pay is set, let the board meeting minutes reflect how individuals voted and their rationales. In the event of any legal challenges, rationales will support reasonability.

2. Don’t Include Particular Board Members’ Opinions.

As previously mentioned, your board meeting minutes should be unbiased. Because of this, board minutes should focus on decisions, not discussion.

On occasion, disagreeing members may state flat-out that they want their disagreement recorded. Avoid this, and instead, simply note that it occurred — no further explanation necessary.

Similarly, if there was a debate, mention it, but don’t make opinionated notations. After all, board meeting minutes are discoverable papers that can be used in any potential legal situation.

3. Don’t Include Summaries of Documents or Presentations.

You should mention presented materials in your board minutes. However, don’t go into great detail about its content. Instead, note where it’s obtainable, so members don’t have to rifle through excess information in the minutes itself.

With comprehensive tools, presentations are easy to locate at any point. Specifically with solutions like Boardable’s Document Center, you can organize and store pertinent records, presentations, and other documents alongside your board meeting minutes.

Plus, Boardable is compatible with Dropbox and other widely-used cloud-based storage systems, making it easily accessible to all board members.

4. Don’t Include Things that Could Subject a Tax-Exempt Entity to Scrutiny.

While there are common distractions in every board meeting, recording them can be problematic in a legal investigation. You’ll want to exclude these distractions. For example, leave out:

- Praise or displeasure.

- Small talk or political banter.

- Negative spin.

- Unnecessary legal terms.

When in doubt, simply leave it out. That goes for anything that could present complications if reviewed later by others. If legal commentary was made or if the nonprofit’s lawyer advised the board, simply note that this occurred in the board minutes. Further, don’t record the substance of the legal advice.

5. Don’t Include Off-The-Record Conversations.

Side discussions are bound to happen, but they shouldn’t be recorded. These off-the-record comments and discussions are certainly allowed to take place, but they must be clearly designated as off-the-record. If a board member brings up an issue that’s worth clarifying but doesn’t appear in the agenda, it doesn’t normally need to be detailed.

Instead, note that directors took the time to discuss items that weren’t on the agenda. Nothing else should be recorded about any tangents.

To avoid these complications, create an Agenda Requests folder in your Document Center. This way, future discussion topics are correctly scheduled into future meetings.

While the content of your nonprofit board minutes will change from one meeting to the next, following a standard outline will help in the minute-taking process to ensure consistency and accuracy. There’s no “right way” to draft meeting minutes, and each organization has its own preferences for what effective ones look like. However, there are several details every nonprofit board needs to record during meetings.

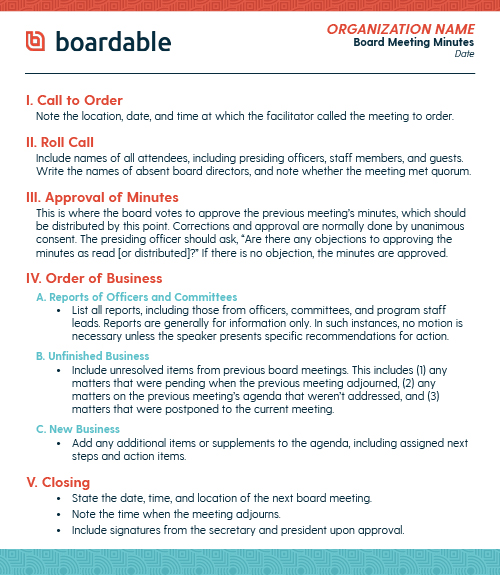

If you’re new to the process, you’re likely unfamiliar with these components, and you may be unsure of where to start when creating a reusable outline. To help, we’ve created a board meeting minutes template that you can use in your own operations based on Robert’s Rules of Order.

If you’re unable to view the above board meeting minutes template, we’ll break it down into five key steps:

1. Opening the meeting, where you include the date and time the meeting started, take attendance, and vote on the approval of the previous meeting’s minutes

2. Reports from officers, standing committees, and any special committees

3. Old business, where you discuss unresolved issues from previous meetings

4. New business, where you discuss any other agenda items that come up

5. Closing the meeting, where you include the date and time of adjournment

While the above board meeting minutes template will serve as a solid starting point, you’ll need to customize it to suit your board’s exact needs. With an outline to go off of, you’ll set your team up for success and ensure all important discussions and motions are recorded in a cohesive, clear, and consistent way from meeting to meeting.

While creating a template manually may work, it’s not optimal. Luckily, current technology offers several options when it comes to accurately recording a meeting with board meeting minutes templates. For instance, Boardable offers tools that enable you to record minutes directly within your agendas, an option which we’ll discuss in-depth below.

5. How Board Minutes Tools Can Help

As you now know, taking board minutes requires substantial work and unwavering attention to catch all the pertinent details. Just like most of your day-to-day tasks, this process can be streamlined with the right technology.

By solidifying your digital strategy and investing in dedicated tools to take notes, it’s even possible to have completed, ready-to-distribute board minutes for everyone just minutes after the meeting wraps up.

For those looking to improve their board meeting minutes and simplify the process altogether, Boardable’s Minutes Maker tool is a great option!

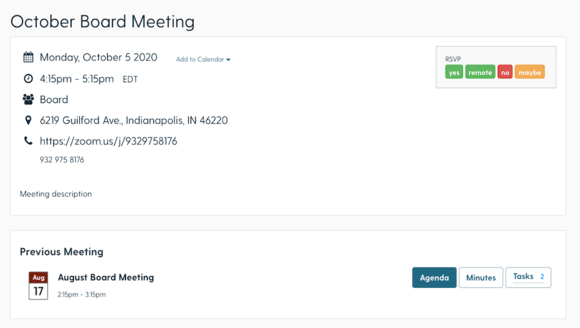

With our dedicated tools, you can take minutes using the agenda you’ve already built to ensure you don’t miss a single detail. Simply pull up your agenda and quickly enter notes, assign tasks, and record votes. From here, any tasks will appear on the assigned individual’s dashboard as a reminder. Take a look at how simple recording notes and assigning tasks is:

Plus, sharing your board minutes has never been easier! Once you’ve finalized them and gotten them signed off on using our e-signing tools, publish them and instantly distribute them to your desired audience. You can choose to make meeting minutes public if desired, and they’re always associated with the meeting and its attendees. You can choose to save a record in your Document Center or email a PDF, keeping everyone updated.

Best of all, you can connect the minutes, agenda, and tasks of a past meeting with the materials for the next one, which makes approval, review, and preparation for upcoming discussions a breeze! Take a look at how simple it is to group meeting information together:

Using dedicated tools can help protect your board from liability and inefficiency by ensuring you catch all vital details. Let Boardable do the heavy-lifting, so you can focus on producing effective notes that capture the essence of your meeting.

Wrapping Up

From documenting discussions to important votes to follow-up assignments, there’s a lot that goes into board meeting minutes. To recap, they’re more than a general account of your board’s conversations and actions. They serve as a reference point for future discussions, inform those who were unable to attend, and serve as an official and legal record of your meetings, so the job shouldn’t be taken lightly.

If you’re unsure where to start when documenting your next meeting, feel free to build out your minutes using the above board meeting minutes template. For a more tailored approach, our powerful board software and intuitive Minutes Maker tool will streamline the process further, ensuring you capture all essential discussion points.

To help you continue your research on effective board operations, we’ve compiled a list of resources that we thought you might find useful. Explore each of these pages to expand your knowledge, so you’ll understand how to instill a spirit of collaboration and efficiency throughout your nonprofit:

-

A Complete Guide to Board Meeting Agendas (with Templates!). An agenda is the staple of your meetings and can serve as a starting point for your board minutes. Explore this guide to learn how to design effective agendas that drive productivity.

-

Virtual Board Meetings: A Nonprofit’s Guide to Success. If you’re making the transition to digital meetings, make sure you’re well-prepared by learning the ins-and-outs of effective ones with this complete guide.

-

The Best Software for Nonprofits [Rated & Reviewed]. If you’re expanding your nonprofit’s digital toolkit, check out these tools suggestions. You’ll find software solutions for effective board management, fundraising, and donor management.

If you’re tired of preparing agendas, budgets, reports, minutes, and all the documents that go into a board book, how about you… BLOW IT UP?

Learn all about how to get rid of the traditional paper board book in this free ebook download. Share the PDF with your team and never create another cumbersome board book again!