Nonprofit Bylaws | Sample Nonprofit Bylaws | Nolo

A nonprofit's bylaws provide the rules and procedures for running the organization.

When you create a nonprofit, one of your most important steps will be to draft the organization's bylaws, which establish the internal rules for operating the organization. The board of directors, tasked with setting policies and overseeing the nonprofit, will follow the rules and procedures outlined in the bylaws. Some states require nonprofits to have bylaws, but it's a good idea to have them even where not required. Bylaws can help directors run your organization, resolve conflicts among directors, and demonstrate to the public and the IRS that your organization is responsibly managing donations to further the nonprofit's charitable mission.

What to Include in Your Bylaws

Your bylaws will provide basic information about your organization and the rules that will govern your board of directors. Although the law does not require nonprofits to include any specific provisions, you should address the following to give your board adequate guidance to run the organization:

- the official name of your nonprofit

- the organization's principal address (the location where you will store your corporate records)

- the organization's purpose (more below)

- an outline of the board structure (minimum and maximum number of directors)

- a list of your officers (such as the president, vice president, secretary, and treasurer) and a description of what each will do

- your procedure for adding and removing board members (including qualifications to serve on the board)

- any term limits for board members

- your schedule for regular and annual board meetings

- details on giving notice of board meetings (how many days before the meeting, and method of communication)

- your rule on quorum requirements (how many board members must be present to make a decision)

- a list and description of board committees (smaller groups within the board to address issues such as fundraising or operations )

- the date that will be the end of your fiscal year (the last month of your budgeting cycle)

- your rules for amendments (how can you change the bylaws), and

- how you will handle the dissolution of your nonprofit (when and how you can close the nonprofit).

Review your state's nonprofit laws to make sure your bylaws are in compliance. For instance, many states require nonprofits to have a minimum of three directors, as well as a president, secretary, and treasurer. When your bylaws do not address an issue that is addressed by state law, your nonprofit must follow the laws of your state. For example, your state might provide that directors serve for terms of one year unless the bylaws provide otherwise. If your bylaws are silent on the matter of terms, by default your directors will have one-year terms; but if you wish, you can use the bylaws to set a different term.

Additional Considerations for 501(c)(3) Nonprofits

Many nonprofits pursue 501(c)(3) tax-exempt status, which allows organizations to avoid certain corporate, sales, and property taxes. Tax-exempt status is granted by the IRS, which does not directly require nonprofits to include specific provisions in their bylaws. However, when you apply for tax exemption, the IRS will look at your bylaws to determine if your nonprofit meets the legal requirements for exemption. By addressing the following provisions in your bylaws, you will increase your organization's likelihood of gaining 501(c)(3) status:

- The nonprofit's purpose: Here you can show that your organization's purpose meets the requirements for 501(c)(3) status. Your organization's purpose must be charitable, religious, educational, scientific, literary, for public safety testing, related to amateur sports competitions, or for the prevention of cruelty to children or animals.

- Conflict of interest policy: An exempt organization cannot provide a private benefit to an individual, including business dealings with board members. Your bylaws should have a policy that addresses potential conflicts, by requiring directors to disclose interests and abstain from voting on matters they could personally benefit from.

- Compensation policy for board members: Exempt nonprofits cannot pay directors more than a reasonable amount for their time and efforts, and many nonprofits have a policy stating directors will serve without compensation.

- Documents retention and destruction policy: Exempt nonprofits must maintain corporate records and meeting minutes, and after a specified period of time (which differs depending on the document), the directors should destroy the records. Your bylaws should set out your procedures for retention and destruction.

- Public disclosure of exemption application and annual tax returns: An exempt organization's tax filings, including the exempt application and annual returns, must be available for public inspection and copying.

- Limitations on activities: Exempt nonprofits cannot engage in political activity or substantial lobbying (read more about the restrictions here), and you can include this limitation in your bylaws.

What Not to Include In Your Bylaws

Your bylaws should address only basic information about your organization and an overview of board procedures, and not the specifics of your day-to-day operations. Do not include rules that will be difficult for your board to follow (which they'll want to change) or procedures that will change frequently, because changing bylaws isn't simple—you must follow legal rules to amend your bylaws (as discussed below). For example, instead of stating the time and address of your board meetings, you can simply state that your board will meet once a month at an agreed-upon location. You might include general descriptions of officer positions that will stay the same throughout the life of the nonprofit, but avoid listing employee positions, which are likely to change.

How and When to Update Bylaws

Make plans to review your bylaws regularly. Review the document whenever the nonprofit undergoes a major change, like moving the organization to a new state or merging with another nonprofit. Also plan to review your bylaws annually, both to make sure you are following them and to update provisions as necessary. To make amendments, follow the rules outlined in your bylaws, which should provide the number of director votes you need to make amendments (if your bylaws do not provide guidance, check with your state's laws). Record the results of the vote in your meeting minutes.

If your nonprofit has tax-exempt status and you make a "structural or operational" change to your organization, such as changing the name or purpose, you must inform the IRS. For smaller changes, like changing director term limits, you do not need to inform the IRS. You can report some changes on your annual tax return, while the IRS requires you to report other changes on different forms. Check with the IRS for details.

How to Draft Nonprofit Bylaws

Your organization's current board of directors will draft and approve the bylaws. Nonprofits often draft bylaws before or shortly after filing formation documents with the state. However, you can create bylaws any time after formation. You can even create your bylaws with Nolo's online form.

Your state laws specify which officers must sign the bylaws, such as the secretary or the president. Unlike other organizational documents, like the articles of incorporation, you do not file bylaws with the state. You must keep them with your nonprofit's records, and ensure they are accessible to board members.

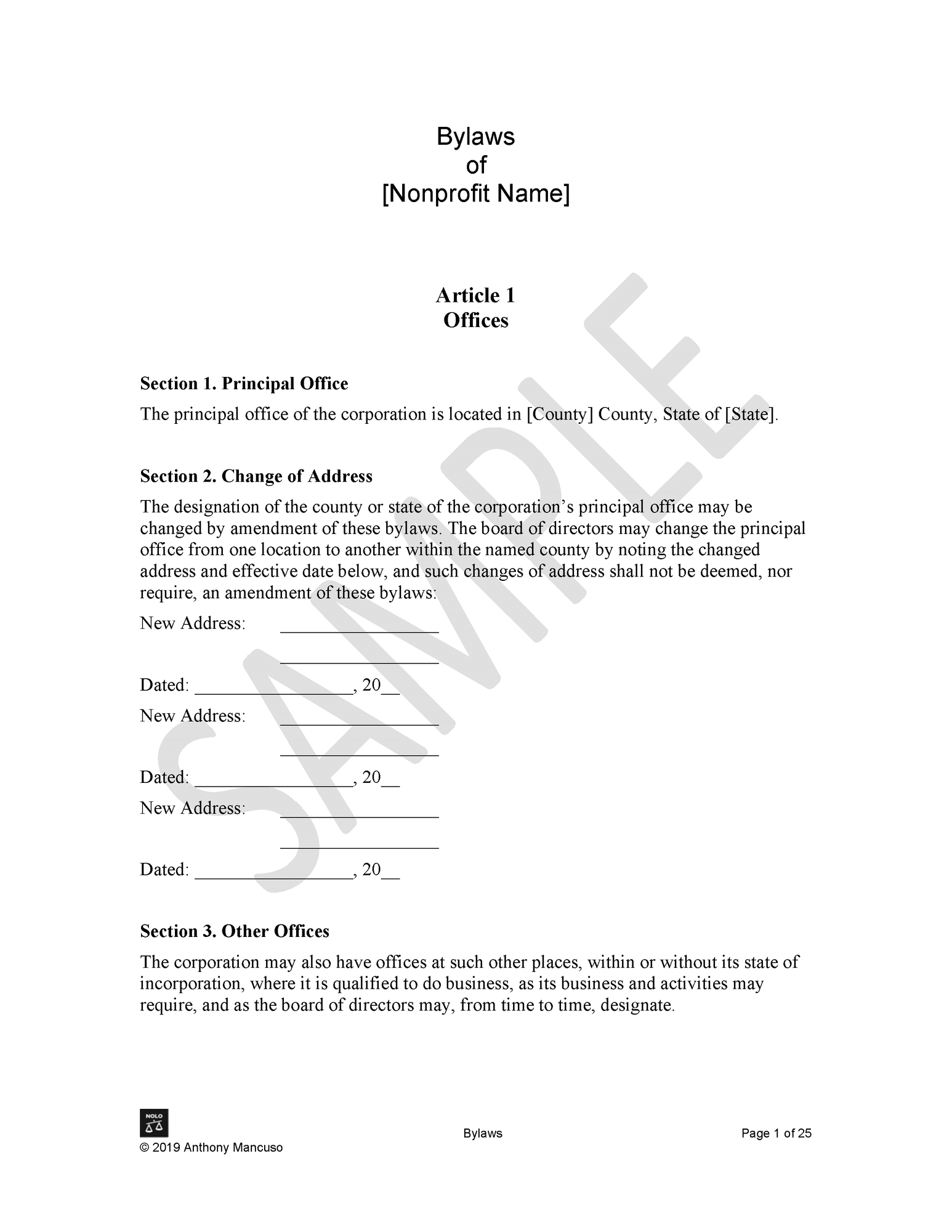

Sample Bylaws

To get you started on your draft, check out the following sample bylaws.

No comments:

Post a Comment